Explain With Examples the Difference Between Capital and Revenue Expenditure

Revenue expenditure is defined as an expense whose benefit is realized during an accounting period. Examples of revenue expenditure include the following.

Capital Expenditure And Revenue Expenditure Basic Concepts Of Financial Accounting For Cpa Exam

The benefit is received within the accounting year.

. Difference Between Capital Expenditure and Revenue Expenditure. For example the purchase of building plant and machinery furniture copyrights etc. According to Guidance Note on terms used in financial statements issued by ICAI Expenditure is incurring a liability disbursement of cash or transfer of property for the purpose of obtaining assets goods or services.

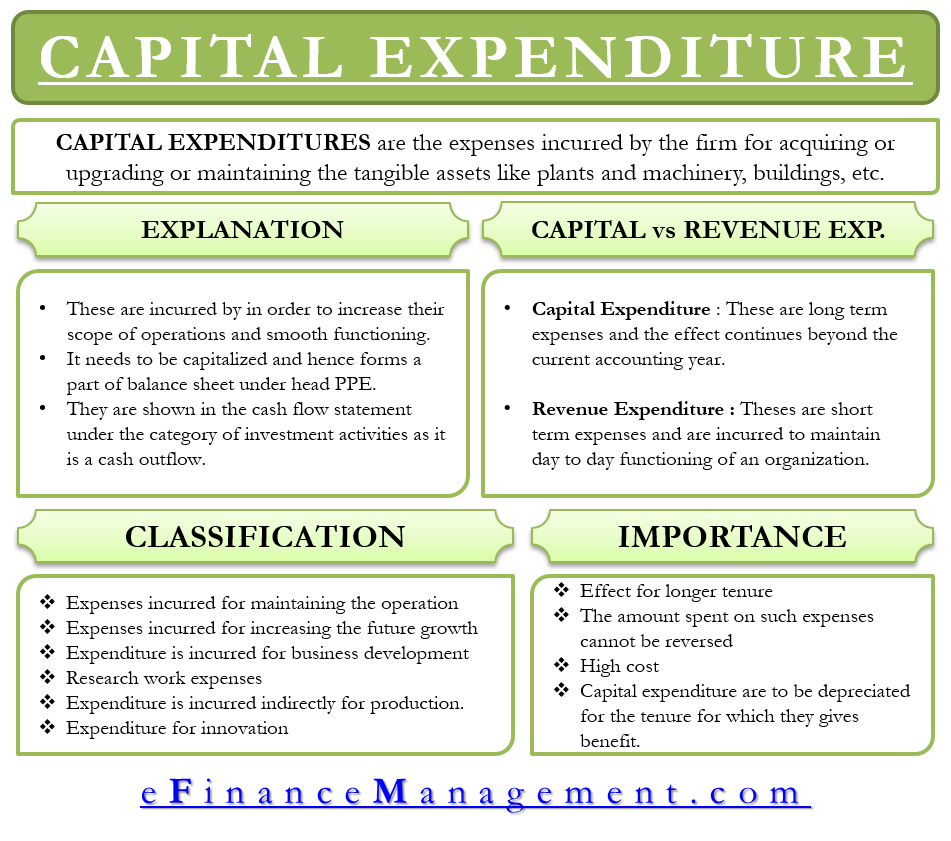

Its effect is long-term ie. Explain the difference between a capital expenditure and a revenue expenditure. CapEx is related to long-term spending a major investment while a revenue expenditure is related to short-term operating expenses.

It is not exhausted within the current accounting year-its benefit is received for a number of years in future. Organizations increase operating capability by. As we know expenses in accounting are incurred for the purpose of generating revenues and revenues accounts are calculated by taking the differences between profit and expenses so Expenses and Revenues Income are basically two types of accounts.

Whereas the repayment of loans is a capital expenditure in nature as it. Fixed assets are long-term items such as building and machinery. These are expenditures incurred for long term benefits.

The longer period of time may include several future accounting periods. The most significant difference between revenue and capital expenditure is that the capital expenditure is meant to improve the general earning. These expen View the full answer.

This is a revenue receipt because it is not helping business. Revenue expenditure is the expense that is used to run your business on a daily basis. It is a revenue expenditure since it helps in maintaining the factory in good condition.

Expenditure incurred for acquiring. Examples of these classifications are buildings computers furniture and fixtures machinery and vehicles. It is a revenue expenditure since the firm incurs it to keep the asset in working order.

On the contrary revenue expenditure occurs frequently. The organization derives benefit from such expenditure for a long-term. 11 Capital and Revenue Expenditure.

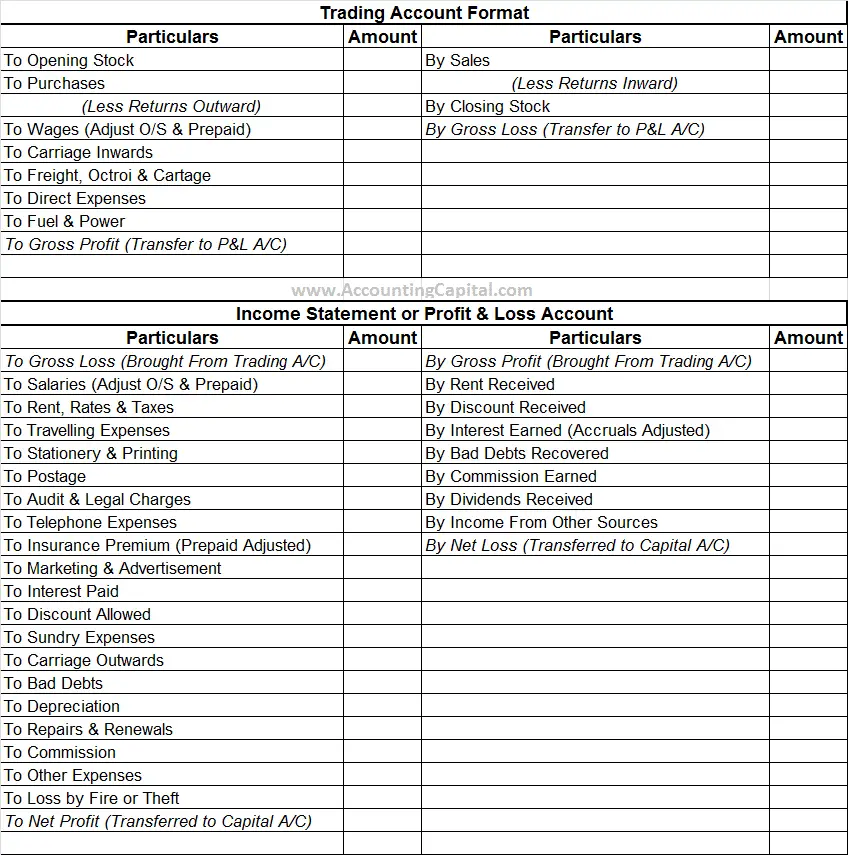

Its effect is temporary ie. The major difference between the two is that the Capital expenditure is a one time investment of money. Capital expenditure is shown in the Balance Sheet in asset side and in the Income Statement depreciation but Revenue Expenditure is shown only in the Income Statement.

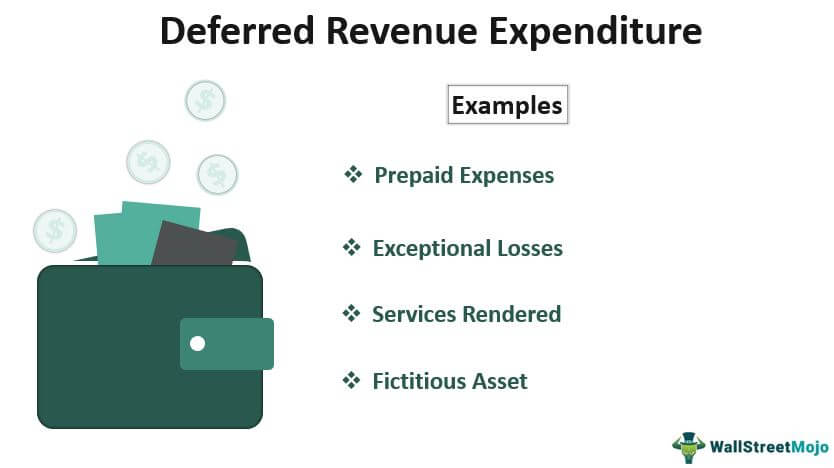

Operating expenses of a business such as production selling administrative and finance cost. Capital expenditure is defined as an expense whose benefit lasts longer than an accounting period. Examples are Rent paid Average Salary of an employee paid fees received stationary purchasedetc.

Capital and revenue receipts. The useful life of a capital expenditure may be determined based on the classification assigned to it. Explain if there are times that it would be in managements best interest to shift an expenditure from a capital expenditure to a revenue expenditure.

The main purpose is to enhance the existing ones or to add a new asset. There are some basic differences between capital expenditure and revenue expenditure. Capital items bought by capital expenditure are fixed assets and intangible assets.

Also give an example of each and explain the difference in the method of accounting for each expenditure. The general guideline for differentiating between capital and revenue expenditure is as follows. Revenue expenditure is money being spend on items used on a regular basis such as buying stock to sell or paying staff payslips.

Capital and revenue expenditure. Any capital expenditure that is below the capitalization limit. Capital expenditure is the money spent by a firm to acquire assets or to improve the quality of.

Capital expenditure leads to the purchase of an asset or which increases the earning capacity of the business. The tax receipts are a prime example of revenue expenditure as they are recurring in nature. On the other hand revenue expenditure is that from which the organization.

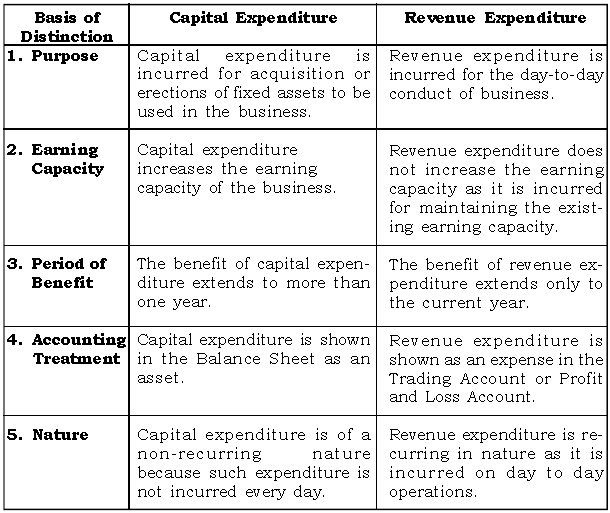

There are two types of expenditures which are capital expenditures and revenue expenditures respectively. 8 rows Key Differences Between Capital and Revenue Expenditure. Capital expenditure generates.

Repair and maintenance expenditure on fixed assets. Cost of operating a fixed asset. Types of Revenue Expenditures.

It is a capital expenditure since it will increase the earning capacity of the business by lowering the costs. Capacity of business and revenue expenditure is aimed at maintaining that earning capacity. Revenue expenses are incurred at a particular time period and are recurring in nature.

17 rows Capital Expenditure. They are both recorded in the same financial year as they are incurred and cannot be forwarded to the next financial year. These are recorded on the asset side balance sheet.

Differences between Capital Expenditure and Revenue Expenditure. It includes the costs used to ensure the proper functioning of a fixed asset repair costs maintenance costs and costs that are incurred for current operations. The capital expenditure is assumed to be consumed over its useful life of the Asset while revenue expenditure has a very very shorter of life.

Revenue expenditures are recorded within the expense classifications. Capital Expenditure - These type of expenditures are those expenditures which are incurred by any company to avail benefits out of it for longer period of time. The capital expenditure has non-recurring nature while the revenue expenditure recurring nature.

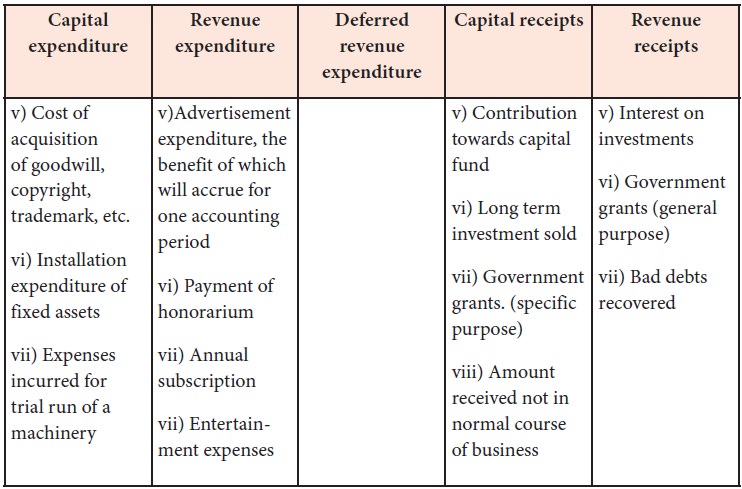

Distinction Between Capital And Revenue Receipts Accountancy

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

How Do Capital And Revenue Expenditures Differ

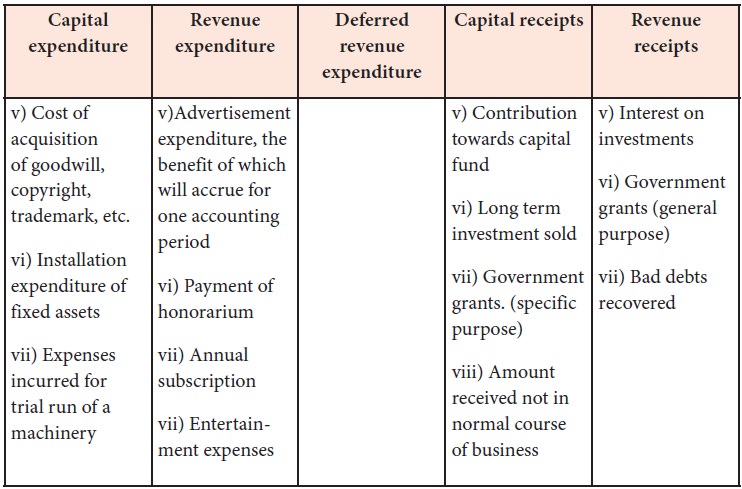

Comparison Of Capital Revenue And Deferred Revenue Expenditure Accountancy

Classification Of Expenditure Types Of Expenditure

Capital And Revenue Expenditure Income Icse Class 10 Notes

What Is Revenue Expenditure Accounting Capital

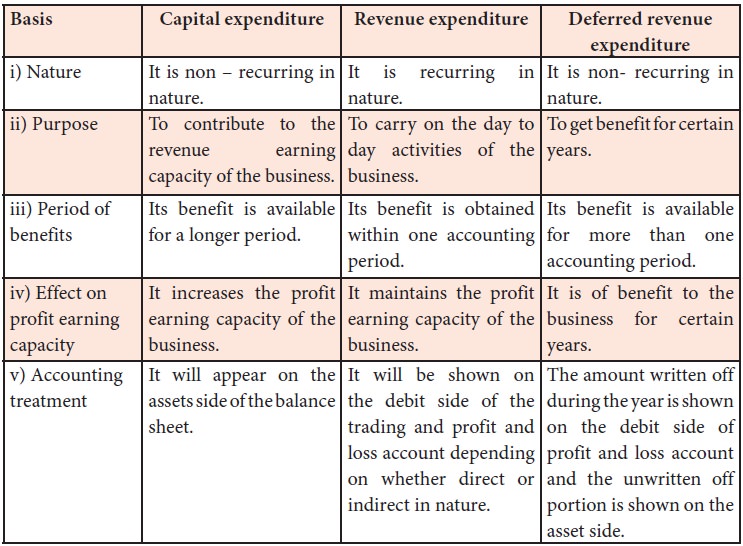

Distinguish Between Capital Budget And Revenue Budget Explain The Components Of Both These Budgets Upsc 2021 10 Marks Synopsis Ias

Capital And Revenue Expenditures Meaning And Differences

Difference Between Capital Expenditure And Revenue Expenditure With Example And Comparison Chart Key Difference

Difference Between Capital Expenditure And Revenue Expenditure Difference Between

Capital Receipts And Revenue Receipts Basic Concepts Of Financial Accounting For Cpa Exam

Deferred Revenue Expenditure Definition Examples

Capital Receipt Vs Revenue Receipt Efinancemanagement

Capital And Revenue Expenditures Meaning And Differences

Capital And Revenue Expenditure Income Icse Class 10 Notes

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-02-0538cfc8437b4b2ba4724c9443c6d393.jpg)

How Do Capital And Revenue Expenditures Differ

Difference Between Capital Expenditure And Revenue Expenditure Difference Between

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

Comments

Post a Comment